Locational Pricing - the Latest "Green" Energy Scam

Locational pricing is being pushed by the usual suspects. What's going on?

1 Introduction

The green grifters are starting to sense trouble.

Donald Trump (“drill baby drill”) is back in power in the US, most countries recently missed a UN deadline for new climate targets, Reform UK has just “put the renewables industry on notice”, and the UK public can see that - contrary to Labour’s false election claim that they would reduce electricity bills by £300 - prices are in reality rising inexorably.

The charlatans need some new snake oil, and they need it fast, so they can bamboozle our incompetent politicians, the corrupt mainstream media, and the useful idiot climate alarmists, in order to keep the Net Zero gravy train going for a few more years.

Everyone with eyes and ears can see that the promised reductions in electricity costs were lies. Now, the same liars are telling us that prices will come down if only we buy their new scam offering: “Locational Pricing” (LP) is the latest wheeze currently being aggressively promoted by the usual suspects.

The claim is that, by breaking the UK power market down into discrete zones or nodes, with different prices in each area, both “curtailment” of renewables and the need for expensive grid reinforcement can be dramatically reduced. This will in turn significantly reduce electricity costs, especially for energy-intensive industrial users such as AI data centres, hydrogen production plants and so on, thus providing a boost to the UK economy.

We can illustrate the idea with a very simple example.

The North Sea is a favoured location of Wind Farm developers because it generally has stronger, more consistent winds than other areas around the coast. But the major load (demand) centres for the electricity produced are further south - for example in the English Midlands and around London in the South East.

If we have a 1 GW (1,000 MW) wind farm generating an average 500 MW over the year (a 50% “capacity factor”), it can contribute up to 500 MW of demand. But if this demand is in the South East, we need to build expensive transmission lines to transport the power across the country. Long transmission lines also lead to relatively high losses in the lines themselves, reducing efficiency and further increasing costs.

Because of the insane contractual arrangements with wind farm operators, we frequently pay them to limit, or “curtail” their output at times of high wind: an output of 500 MW is an average - sometimes, in a wind drought, the output could be nothing, while at other times it could be close to the full “nameplate” capacity of 1,000 MW. But building a transmission line capable of transporting 1,000 MW, for the few hours in a year when that much power might be available, would be even more expensive - it may be “better” to optimise transmission costs at the expense of occasionally wasting some surplus wind capacity available at low marginal cost.

This situation is publicised by the charlatans responsible for the whole mess as “paying wind farms to switch off”, but of course we only pay them to do so because the insane contracts provide for that - and it’s actually worse still in practice. In the mad dash for “cheap, green” power, the climate alarmist establishment has often encouraged the construction of wind farms well in advance of any new transmission lines. So, in our simplistic example above, we cannot even transport the average 500 MW from the wind farm to the location of the demand.

To get an idea of the costs involved - paid for by us through our electricity bills - the Daily Mail reported that “constraint” payments reached a total of £380 million in 2024, while one new wind farm was paid £2.5 million in a single month to curtail its output. But this is just the beginning; Ed Miliband’s insane plans to achieve “clean power” via a “decarbonised grid” by 2030 will inevitably mean thousands more wind turbines and, ultimately many £billions in constraint payments.

So the climate alarmists and opportunistic chancers who have captured the UK power industry make a bold, “obvious” proposal. Use the “cheap wind energy” at source - build power-hungry industrial facilities (AI data centres, hydrogen production plants and so on) along the Scottish coast, where the subsea cables from wind farms come ashore. This can be achieved, they claim, via “price signals” - making electricity cheaper in areas (and at times) of abundant supply and more expensive in areas (and at times) of scarcity. This is known as Locational Pricing - and of course, regional prices would have to be dynamic to take account of the intermittency of wind and solar.

We would not need expensive, loss-heavy transmission lines, and we could avoid paying wind farms to switch off due to transmission constraints. What’s not to like? Reduced waste, less capital expenditure, and cheaper power for all!

Except that - as usual - it’s all complete, disingenuous hogwash, as we shall explain. We will examine the nonsense from three angles:

i. Fundamental analysis - what issues might LP address and (how) would they work?

ii. Who are the proponents of LP in the UK and what do they claim?

iii. Following the money - cui bono?

Item ii. in particular is not straightforward. There are no detailed proposals from the LP champions - it is difficult to debunk a scam story when there is, in fact, nothing of substance to debunk. The sound-bite nonsense, put forward by the grifters and amateurs perpetrating the scam, is so ridiculously fraudulent as to render the whole subject unworthy of discussion among serious people. Unfortunately, with climate alarmists and Net Zero charlatans, we are not dealing with serious people; it is therefore incumbent upon us to at least attempt to debunk their deceptive claims.

2 The Fundamentals of Locational Pricing

2.1 Complex (“technical”) Content Alert

The subject of Locational Pricing is somewhat arcane and technically complex - which is precisely how the charlatans who promote the idea get away with misleading our typically inept politicians and media commentators.

As ever, we will endeavour to avoid unnecessary technical detail and to present our counter-narrative in lay language as far as possible. However, readers should be aware that this topic cannot be properly understood without some mental effort. The issue encompasses almost the entire scope of the UK electricity system design, and impinges on / is impacted by the full path to a Net Zero future in the UK.

Despite our best efforts, this will not be an “easy read”.

2.2 What is Locational Pricing?

LP essentially means abandoning the existing UK-wide wholesale market for electricity and dividing the country into regions, each having their own dynamic market prices. In theory, this could be applied at various levels of granularity - our simplistic example in the introduction showed just 2 zones (North and South) but in reality the situation would be far more complex. Potential scenarios considered by Ofgem for example, would result in anything from 7 regional zones to dozens of “nodal” price regions.

But why would we do this - what would be the motivation? By way of further explanation, we elaborate briefly below on the outline provided in the introduction.

In an electricity market increasingly dominated by intermittent, variable renewables, some specific new challenges arise:

Unlike thermal power plants using heat from fossil fuels and nuclear reactions, we cannot transport wind and sunshine to convenient locations close to natural load centres and use them to provide “dispatchable” power when we need it.

We do not and can not control nature. Optimal wind and solar conditions do not align perfectly (or even approximately) with our need for electricity - from either geographical or timing perspectives. The “best” conditions for wind generation are far out in the North Sea, well away from existing centres of energy demand, while maximum solar energy is available on long summer days, not in the dark evenings of mid-winter when UK energy demand peaks.

For simplicity, as we have in some of our other articles, we will largely ignore solar and concentrate on wind in this paper.

In order to move electricity from remote, largely offshore, locations to existing load centres, we need to build new transmission lines to transport the power. These lines take time to build, have significant costs, and can adversely impact the environment.

In addition, even if we build sufficient transmission capacity to transport 100% of peak demand, there will still be occasions when available supply exceeds demand. This could be because of a timing mismatch - e.g. strong winds in the North Sea over a summer weekend, when demand is low - or as a consequence of the need to “overbuild” wind capacity to meet peak winter demand. In terms of the former, note that - although we will not focus on solar here - the abundant presence of competing solar energy in summer will compound the issue for wind in terms of market (rather than technical) constraints.

With regard to the consequences of overbuilding, we have discussed this in various earlier papers (e.g. section 4.2.2.1 here) so we will not re-visit it in detail now. The important point is that, if an offshore wind fleet with a winter capacity factor (CF) of 60% is constructed to meet 100% of peak demand, there will be times when an instantaneous CF of, say, 90% means that supply will be 150% of demand.

At times of excess supply over demand, output from offshore wind farms needs to be “curtailed” - i.e. wind farms paid to switch off. In addition, if there is insufficient transmission capacity to transport 100% of demand - even if there is no excess supply - wind farms must also be curtailed due to these transmission “constraints”.

The basic principle of LP for the UK is to minimise the impact of these issues, and provide a mechanism to make any “free” excess supply available to energy-intensive customers able to make use of it at locations adjacent or close to the source.

The inference is that reduced capital expenditure on transmission lines, together with reduced constraint payments, will be a general benefit (which would therefore “reduce costs for everyone”), while encouraging the “local” consumption of excess supply would reduce costs in areas of abundant wind (or solar).

So the whole idea of LP is to offer different prices in each zone (or node in the most granular implementation), in order to encourage:

Generators to build capacity close to natural load centres, and/or

Consumers to (re-)locate to areas of abundant supply.

The mechanism of encouragement would be via “price signals”, i.e. by having separate wholesale markets for each LP zone or node. We can illustrate via a couple of specific examples.

Let’s say you are a large AI company considering building a new data centre in the UK. With the existing UK-wide market, you may be incentivised to build it in the South East, close to London - where your fibre data connection costs are likely to be minimised, and skilled staff readily available. However, if there was a penalty in terms of higher power costs in the South East (or conversely, a significant benefit from lower costs in Scotland), you may choose to build in Scotland instead. In the extreme case, cheaper power costs could be the difference in deciding to invest or not - that is, there are potentially major consequences for the attractiveness of UK investment for globally important industries.

Now consider a wind generator assessing the investment case for a new UK wind farm. With the current arrangements, the incentive is to build it in the North Sea off Scotland, where the wind is most favourable to maximise production. But if higher wholesale prices were on offer in the South East, this could encourage more wind farm construction in, say, the Thames Estuary or the English Channel.

Now you may be thinking that this is all rather complicated - contrived even - and we may be tempted to agree with you. Much simpler to just build coal, gas and nuclear generation, at a fraction of the cost. Below, we will delve into some of the (mostly invalid) assumptions and complications implicit in the fantasy narrative.

2.3 Can Locational Pricing Work?

2.3.1 Can LP Work in Some Specific Circumstances?

The short answer is yes - after a fashion.

Imagine that you are a national government with an abundant hydro power source - with reliable flow regulation / storage (i.e. dammed rather than run-of-river) - in a remote location, or that you are considering the investment case for a new nuclear power station.

If you need to build a huge amount of transmission infrastructure (grid lines) to deliver the new power to your load centre, your project may not be economic - or the price you need to charge for the power produced might be exorbitant, making it effectively unsaleable.

But if you can encourage a data centre operator or a hydrogen producer to locate their facility close to your new power station, in a “low cost” LP zone, you can “reduce prices,” especially for energy-intensive users.

Such arrangements have in fact been common practice in many parts of the world for decades, a classic example being aluminium smelters who have been able to construct facilities adjacent to hydro power stations. But there are a couple of key points to note:

For a large industrial user, such as an aluminium smelter or a data centre, to have the confidence to invest significant sums in a low cost electricity zone, they need to be assured of the available of “firm” power - i.e. a reliable 24/365 supply.

A regulated hydro plant or a nuclear facility will give them this, an intermittent supply from a wind farm will not. We are straight back to the old question - what happens when the wind doesn’t blow?

If the lion’s share of power from a new generation plant goes to a single large user, or a small group of users, it obviously doesn’t benefit everyone else in the wider community. A new data centre in Scotland may be beneficial for the economy, but it does nothing to resolve the overall supply-demand equation nationally - the net effect is zero.

In the case of aluminium smelters in many overseas countries, where overall power generation is often insufficient to meet the full demand of the country, the effect has sometimes been far more pernicious and corrupt. Precious hydro resources are monopolised by powerful corporate interests, leaving residential customers to suffer high electricity prices and frequent power cuts.

If you think something like this couldn’t possibly happen in the UK, after all that has happened over the past few years, perhaps you aren’t cynical enough.

2.3.2 Can LP Work in a Renewables Dominated UK?

Aside from the final point, the above scenarios are not hugely relevant in the context of how and why LP is being aggressively promoted by certain vested interests in the UK.

The justification for LP in the UK is to maximise the return from renewables (mostly wind), which might otherwise be curtailed in a single country-wide electricity market. So we need to consider if and how LP might work in a UK “clean power” (by 2030) or Net Zero (by 2050) scenario - and there are some rather significant issues.

i. The case for LP is predicated on false claims of “Cheap Renewables”

The entire narrative that LP arrangements, of any kind, could ever benefit ordinary UK electricity consumers with access to cheap renewables is based on a fundamental deception; that renewables are “cheap” in the first place.

It is perfectly true that the marginal cost of wind and solar generation, during periods of abundant wind or sunshine, is low. However, under the standard “Contracts for Difference” arrangements in the UK, renewable generators never provide electricity at the marginal cost. Instead, they receive their contracted “strike price” (or alternative legacy subsidised arrangements) as we and others - including David Turver, who recently delved into the LP scam from a financial perspective (recommended) - have repeatedly explained.

In the latest auction round (AR6) concluded last Summer, strike prices for offshore wind were around £100 per MWh in 2024 prices. This is a reflection of the true “levelised cost of energy” (LCOE), or basic wholesale, cost of offshore wind - before network costs, balancing costs, supplier costs and so on. In a fully detailed assessment of whole system costs, we previously estimated that this equated to a true retail cost for offshore wind of 33p/kWh - compared to just 14p/kWh for CCGT.

As is so often the case, the fraudulently misleading claims of the LP proponents are based on a kernel of truth. If the UK could implement a robustly designed LP regime, wind farm developers could potentially rely on slightly increased capacity factors (still limited, in practice, by significant market constraints) - thus enabling them to bid at slightly reduced strike prices in future auctions. This though would be an extremely marginal effect - just a few percent reduction, at most, in future bid prices.

Furthermore, in theory at least, reduced transmission costs could provide further benefits as far as final (whole system) retail costs are concerned. Again, however, as we elaborate below, any “benefit” would be extremely marginal - and, critically, would only serve to limit the increase in future prices. Inferences that LP could ever reduce future prices in absolute terms - as claimed in a recent TwiX post by Octopus Energy - are simply false. AKA disinformation. AKA fraud.

ii. Transmission costs are a relatively minor component of overall Net Zero costs

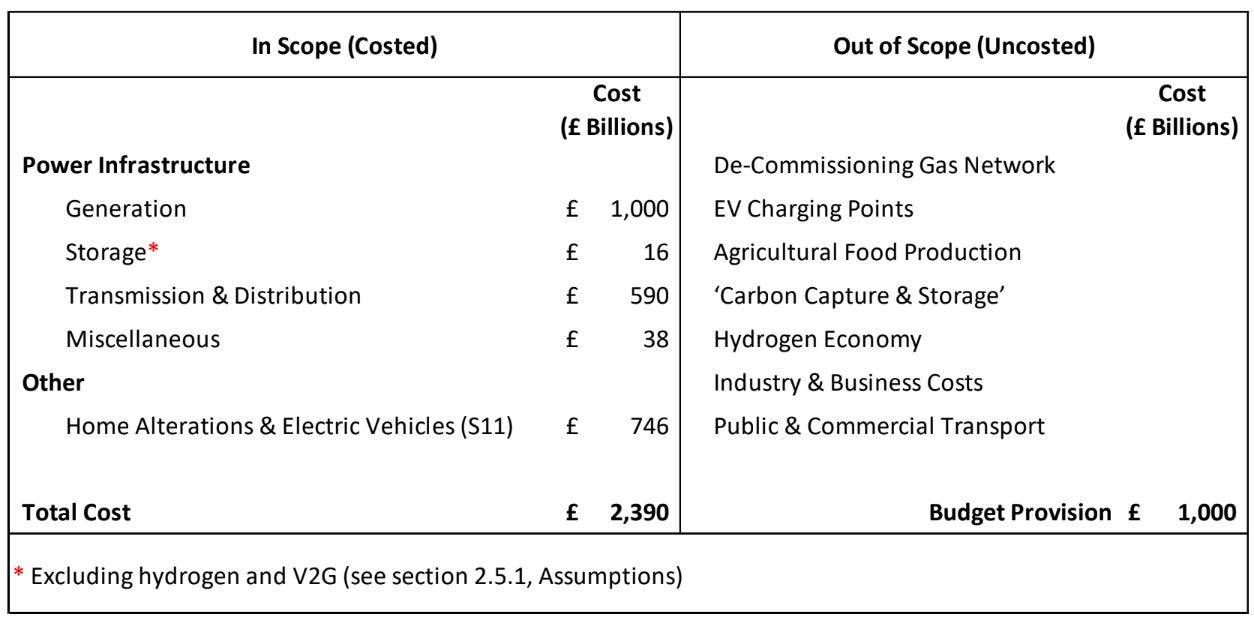

As per our previous work, transmission costs, while significant in absolute terms, are a relatively minor component of the overall £3.4 Trillion national Net Zero bill.

Approximately £355 billion of our estimated £590 transmission and distribution costs relate to the transmission network - around 10 % of the total Net Zero bill, or 22% of the £1,644 billion relating directly to the power infrastructure.

Assigning an appropriate proportion of Net Zero transmission costs between new connections (to transport renewable energy in a 2030 Clean Power scenario) and reinforcement (to support hugely increased loads in a 2050 Net Zero scenario) is a complex undertaking requiring a significant number of assumptions - details available in the referenced paper above, for anyone interested.

For our purposes here, it is sufficient to quote an extract from the referenced paper:

“ … since the additional transmission network costs we analyse above are mostly for reinforcement and design optimisation, not basic connection costs. These reinforcement and optimisation costs are fundamentally a function of increased Net Zero demand, not of the precise generation technologies to deliver that demand, so they will be required in any event.”

We will take a very simplistic approach (since, given the number of variables and unknowns, anything else is to claim more engineering rigour than is justified) and assume that 50% (£178 billion) of the transmission expenditure we previously calculated relates to connections, with the rest to reinforcement. If we (generously) assume that LP could reduce the £178 billion connections component by 25%, we arrive at a possible saving of £44 billion, around 2.7% of the overall power infrastructure costs associated with Net Zero (or ~1.3% of the total Net Zero bill).

So, even if Locational Pricing could be made to “work” in a UK Net Zero scenario, the maximum power infrastructure “saving” (avoidance of additional costs), would be less than 3%.

The whole LP “debate” is therefore deflective, deceptive chaff. But, for the sake of completeness, we will continue.

ii. Curtailment is a feature, not a bug, of variable renewables generation

The claim that curtailment can be significantly reduced is highly questionable.

In terms of potentially avoided costs, our previous analysis of transmission costs, based on National Energy System Operator (NESO) assumptions, already factored in some reductions in curtailment costs due to an optimised “holistic network design” (HND), but this is only part of the story.

In an overbuilt Net Zero scenario, curtailment of wind generation will be due to two separate issues - technical transmission constraints, and market constraints which are rarely acknowledged. Let’s say that in a low cost LP zone we have a peak winter demand of 50 GW. To meet that demand from a wind fleet with a winter capacity factor of 60% would require a total nameplate capacity of 50/0.6 = 83 GW. At any time of high wind, when that 83 GW of capacity could produce more than 50 GW of output, the system will face the possibility of market curtailment - there is no local demand, even during the winter peak, for the “extra” 33 GW. Of course, it can be argued that this surplus can be exported to other zones (via transmission lines!), but there is no guarantee that other zones will need it - especially in Summer, when solar generation will be at its maximum.

Without knowing the exact nature of the “relocated demand” in an LP scenario, it is impossible to accurately estimate the size of any annual market surplus - and it is therefore impossible to make any credible claims about overall curtailment savings. There are just too many moving parts.

iii. Potential beneficiaries of LP would be new consumers of electricity

As explained in 2.3.1 above, providing commercially beneficial prices to a select group of new energy-intensive industrial customers - such as data centre operators, aluminium smelters, etc. - while beneficial to those specific customers, and potentially to the wider economy in terms of employment, tax revenues and so on - does nothing as far as contributing to existing energy demand.

It is almost entirely orthogonal to the question of how we meet the current energy needs of the UK going forwards. In fact, the only connection is a negative one: these new consumers of electricity will require firm 24/365 power. Somehow, when the wind doesn’t blow for extended periods (when battery “storage” will be next to useless), the rest of the system will need to provide backup power - depleting the pot available to everyone else.

In other words, the obvious consequence of attracting new, energy-intensive industries such as AI data centres to the UK, would be to increase the overall demand for energy. Since supplying the entire energy needs of the UK from renewables (and other “low carbon” sources) in a Net Zero is already a delusional fantasy, entertained only by madmen, the idea of supplying an increased demand from these unreliable sources is beyond insane.

The only feasible way to avoid this would be with hydrogen production and storage facilities - which could theoretically ramp their usage up and down according to the availability of wind, and then contribute positively by providing energy during a “Dunkelflaute”. But the efficiency of hydrogen, especially the round trip efficiency when used to generate electricity, is very low. If restricted by the intermittency of wind energy, the overall efficiency of the plant (and the return on capital investment) would be significantly reduced. We will therefore file this possibility under “non-starter” with current technology.

iv. Potential beneficiaries of LP want reliable 24x365 power

As already mentioned, a backup source of power will be needed for when the wind doesn’t blow for extended periods. As we have already seen this winter, this scenario is far more frequent than many Net Zero advocates have claimed.

In the absence of a feasible storage solution (and there are no economically feasible storage solutions), the power then needs to be supplied either from local backup generation or via a transmission connection from “somewhere else”.

Alternatively, other (residential & small business) customers demand needs to be curtailed - almost certainly via “price signals” (aka rationing by unaffordability). This is what the establishment neo-Marxist globalists mean when they talk about “flexibility”, and is a modern UK parallel for the fate of residential customers denied energy by aluminium smelters, as outlined in section 2.3.1 above.

If power is supplied from another LP zone, the problem is obvious; part of the rationale for LP in the first place was to avoid the need to transport wind energy around the UK (simplistically, from North to South) - saving on both capital expenditure and transmission losses. But we now still need transmission lines of comparable capacity to back-feed the demand in the North. There would still be a saving on overall transmission losses, but the economic benefits are nowhere near as clear cut as might first be assumed.

And what should a “fair” wholesale cost be to provide this backup power power from an LP zone in the South to one in the North - bearing in mind that, in the winter, this would necessitate the operation of “last in the merit order” generation plant - very likely low-efficiency open cycle gas turbines (OCGT’s)?

v. There is no evidence of net benefits to anyone from a fair LP mechanism

In a fair market, as above, backup power during Dunkelflaute conditions for customers normally supplied by “cheap” wind should be very expensive - significantly impacting overall annual average prices for affected customers and thus undermining any economic case for LP.

Then there are associated complexities in the existing market arrangements which would need to be factored in to the overall assessment:

Firstly, Distribution Use of System (DUoS) charges already vary by region, according to which one of 14 Distribution Network Operators (DNOs) a customer is physically supplied by in Great Britain.

Secondly, electricity customers in Scotland currently benefit from the Hydro Benefit Replacement Scheme, which effectively discounts increased DUoS costs in remote regions of Scotland. How “fair” would it be, were these customers to gain the benefits of transmission system savings while continuing to be shielded from additional distribution system costs?

vi. There is no assurance that the resulting market complexity can be effectively managed

In recent decades, there have been many fundamental and radical changes to the operation of wholesale and retail energy markets in the UK. Around the millennium, some very smart, capable people implemented many of these changes with great success. However, the challenges of that time - overseen by genuine industry professionals - were relatively “trivial” compared to the idea of disingenuous, amateur ideologues attempting to introduce dynamic Locational Pricing to a renewables-dominated UK energy landscape.

For the sake of brevity, we won’t go onto any further details of these challenges here (happy to engage in the comments, if anyone has specific questions), but we would point to the “Smart” Metering fiasco as evidence of what can go wrong when we let grifting cult fools loose on our electricity system arrangements.

vii. Impact on local Distribution networks

The implementation of LP implicitly requires that all retail customers are exposed, at least to some extent, to varying real-time wholesale prices - in the way for example that a small number of Octopus Agile customers already are today.

This means that, at times of abundant supply in any zone, customers in that zone would be encouraged to maximise their consumption of “cheap” electricity. But there is no current mechanism by which market operators can have visibility of loading conditions on local distribution networks. Encouraging everyone in Edinburgh to draw maximum load on a windy Scottish evening could result in widespread distribution network blackouts throughout the city, as local fuses blow in neighbourhood substations.

In the words of Ofgem (emphasis ours):

“1.11 This assessment is ‘transmission-first’ in scope. While distribution-level locational pricing is theoretically possible, it has not been applied in practice and would likely represent a much greater implementation challenge. However, as noted in Section 3, it is important to understand the potential impact of a transmission-level zonal or nodal pricing on the distribution network.”

Readers may not be surprised to learn that no one has actually thought this through.

3 What do Proponents of UK Locational Pricing Claim?

The short answer to this question is … not very much. Most of the vocal fraudsters advocating for LP across social media and in interviews with incurious, gullible mainstream “journalists”, are based on nothing but empty soundbites and circular references, whereby they all religiously quote each others’ baseless claims.

However, the “official” position of Ofgem is contained in an October 2023 report, from which the following is a direct quote:

“Analysis commissioned by Ofgem indicates that, based on network plans approved by Ofgem under the Accelerated Strategic Transmission Investment (ASTI) framework, locational pricing could deliver significant net socio-economic benefits of up to £14bn (NPV, 2025-2040). The benefits to consumers could be larger as locational pricing could result in an additional transfer from generators to consumers in the form of congestion rents, with consumer benefits as high as £34bn. From the domestic consumer viewpoint, this would be equivalent to an average £38 a year saving. However, further work will be needed to assess how such consumer benefits could be allocated without disrupting investment.”

“Further work will be needed.” Of course it will - see Cui Bono below. The consultants advising Ofgem will no doubt already have pocketed 6, or even 7 figure sums for their efforts. The gravy train will continue to chug along under the heading of “further work”. Nice work if you can get it.

Ofgem’s figure of £14 billion is in fact just a fraction of our own rough and ready estimate of maximum £44 billion “saving” outline above (so don’t believe us, believe Ofgem, although our methodologies and timescales vary, so we are not really comparing apples with apples) - and £14 billion represents less than 1% of the total £1,644 billion we estimate to upgrade the UK power system for Net Zero.

If we look at the entire cost of Net Zero to the UK, including non power system costs and estimated by us at ~£3.4 Trillion, the potential “saving” as assessed by Ofgem is just 0.4%.

And remember - this is all based on the highly dubious assumption that Locational Pricing would actually “work” at all in the UK. As detailed at section 2.3.2, we are far from persuaded. Furthermore, given that the Smart Metering programme in the UK has probably cost in excess of £20 billion, it is likely that the administrative costs of implementing and operating a market with Locational Pricing would quickly exceed any theoretical savings on transmission capex and technically constrained curtailment payments.

4 Cui Bono (who benefits)?

There are at least three categories of people who would benefit from the introduction of Locational Pricing in the UK. Spoiler alert; they don’t include us little people.

i. Everyone involved in the renewables energy industry

As outlined in the Introduction, the “green” grift is fast running out of steam. More and more people are waking up to the lies about “cheap, reliable, home-grown” renewable power.

The snake oil salesmen need to prevent - or at least delay - everyone else waking up, which would signal the final halt for the lucrative Net Zero gravy train in the UK. While it may be difficult for anyone who has already seen through the lies to understand that others could be fooled, yet again, by false promises of “price cuts tomorrow”, the old adage applies: you can indeed fool some of the people all of the time.

Blaming high prices on “wasted wind” and dangling the carrot of lower prices in future via LP, gives the charlatans one last way to rinse the gullible. Remember “two more weeks to flatten the curve”, “15 million jabs to freedom”, and so on? Remember too how we all swore that we wouldn’t get fooled again?

Those who forget history are destined to repeat it, or at least “history doesn't repeat itself, but it does rhyme”.

ii. Energy intensive industries who can exploit low electricity prices in favourable LP zones (and ride out periods of massively increased prices during Dunkelflautes)

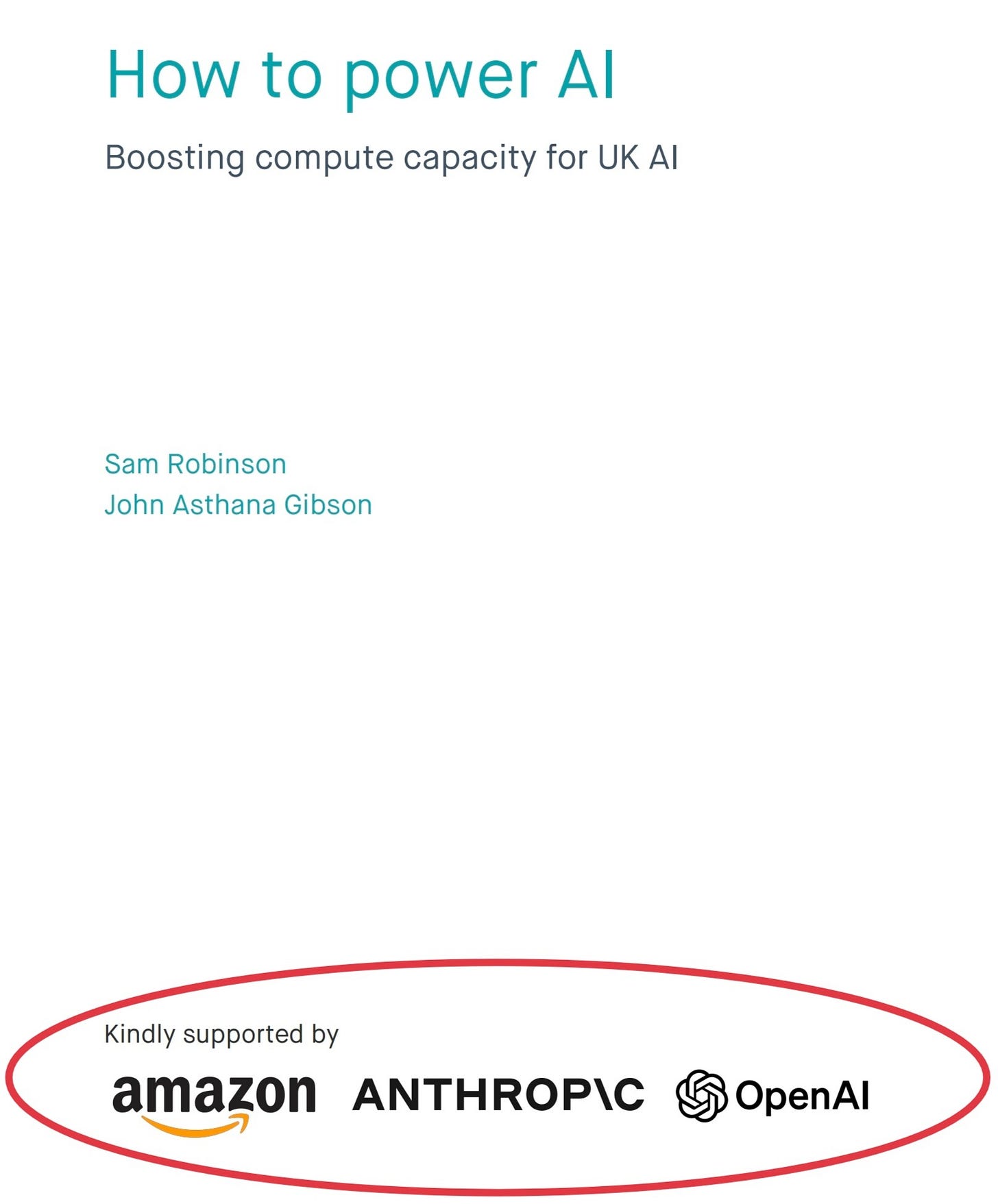

The following promotion of a recommendation from an “independent” think tank was recently posted on TwiX.

The recommendation came from a report sponsored by three non-UK companies with massive vested interests in cheap electricity for data centres.

But does this really matter? After all, lobbying and competition amongst financially vested interests is at the very heart of the western capitalist system - it’s healthy, isn’t it?

When done fairly, honestly and transparently, yes. But in this case, none of the nuanced complexities of LP as we discuss in this paper are covered - there is a fundamental assumption that the benefits of LP pricing, to all, are obvious and proven. If such assumptions are made by adequately qualified experts, a case could be made for arguing that settled expert “consensus” obviates the need to repeatedly re-justify basic postulates. So are the authors of this report - and their colleague who promoted the conclusions on TwiX - “experts” in the energy industry? Well, no:

So what we have, essentially, is a group of lay people, paid by vested interests, to produce a report which recommends an action plan which benefits those vested interests. If only there was a word for that?

iii. Specialist consultants and service providers who can establish and operate the new market arrangements

Establishing and operating a LP system in the UK would be a major logistical undertaking. Defining and setting up the market mechanisms, detailed processes and software systems represents a highly lucrative opportunity for specialist providers - for example Octopus Energy and their vocal, LP advocate CEO, Greg Jackson.

Remember that, as well as being a market participant (renewable generator, and supplier), thus benefitting under point i. above, Octopus are also a software company (owners of the “Kraken” billing system). Very convenient!

5 Conclusions

As is so often the case with the climate alarmist / Net Zero scam, all we have from the establishment, and from vested interests such as Octopus Energy, are vacuous soundbites based on nothing.

The UK does unfortunately have a significant minority of people particularly badly infected with the woke mind virus. But most of the population is not completely stupid, and has noticed the disconnect between the Net Zero lies (“cheap green energy” and the reality of ever-increasing bills. It’s like a dystopian version of the famous comedic pub poster.

All the usual suspects are in on the LP scam, which is nothing more than the latest snake oil promoted by those who have led all previous aspects of the fraudulent exercise that is Net Zero. This latest lunacy is facilitated by the current Ofgem consultation on the Review of Electricity Market Arrangements (REMA). Renewables have undeniably broken existing market arrangements - so, instead of ditching the whole mad scheme of Net Zero, let’s double down and invent new lunacy which will be unworkable (and likely further increase costs) in the real world.

There is nothing wrong, in principle, with Locational Pricing in a “traditional” scenario of dispatchable energy sources, such as dammed hydro power. But in a renewables dominated system, the concept requires “flexibility”. Since the grifting zealots cannot control the supply side of the equation, they will need to control the demand side, i.e. your access to power at peak times. Via our “Smart” meters and new “Smart” appliances, we will all be exposed to implicit rationing, via dynamic pricing, and explicit rationing via remote control of our home appliances and electric car chargers. Aside from the financial grift, rationing is the true driver of LP.

As usual, there are an awful lot of villains in this story, but the role of Octopus Energy is particularly sinister. Looking at their response to the REMA consultation, we can ignore the usual puerile chaff we’ve come to expect from Octopus (“using green electrons when they are plentiful and cheap”) and focus on examining the outright disinformation being peddled, which reveals an open attempt to mislead for commercial benefit. The use of phraseology such as “flexible low carbon assets” in is a complete and wilful deception perpetrated on the gullible fools to whom Octopus and others are addressing their pernicious propaganda. Wind and solar farms are anything but “flexible” and to describe them as such is a deliberate, calculated inversion of the truth.

The Octopus blog article is a masterpiece of empty word salad from start to finish, littered with unsupported , unevidenced nonsense such as: “An efficient power system is now one where demand and other flexible assets shift in line with renewable supply, rather than vice versa.”

In this paper we have explained the truth of Locational Pricing, in a UK Net Zero context.

The claimed benefits are fiction.

The logistical complexity almost certainly makes it undeliverable.

Consultancy and administrative costs would almost certainly exceed any possible “savings”.

If a working arrangement could somehow be miraculously delivered, the theoretical reduction in future costs increases (not price reductions) would be a trivial 1%. Instead of costing the UK a ruinous £3.4 Trillion, Net Zero would cost a mere £3.386 Trillion - and the country would still be bankrupt.

The usual suspects would continue to get rich.

The main result for ordinary people would be extreme rationing of power at times of peak demand and low supply.

The main takeaway for lay readers considering “what to believe” around this complex topic should be this: as with everything else to do with Net Zero - and many other “current thing” political topics - there is no detail underpinning the claims from Locational Pricing evangelists.

They never quantify the “reductions” in your bills, they never tell you what “demand flexibility” will actually mean for ordinary people - unaffordable (rationed) power when vast corporate interests such as AI data centres consume the entire depleted energy available in a Dunkelflaute. And they lie to you, constantly, about the £3.4 Trillion that Net Zero would cost the UK - Locational Pricing or not.

It is nothing but hot air, designed only to confuse the innocent and perpetuate the fraud.

They will wreck the national energy infrastructure long before they could ever get anything as complicated as Locational Pricing up and working if they press ahead with Net Zero as planned. Paul Homewood has just posted that mad Miliband is planning to spend £242billion to save £2billion a year! https://www.conservativewoman.co.uk/the-climate-scaremongers-milibands-economics-of-the-madhouse/.

How much longer must we suffer before Net Zero is finally euthanised? How can the UK Uniparty continue to press ahead with pointless, self-sabotaging Net Zero when the American people have turned their backs on the climate change “hoax”, as President Trump disdainfully calls it?

Trump and his MAGA team are dismantling the US deep state at breakneck speed. It’s not just his “Drill baby drill” and withdrawal from the Paris Climate Agreement. Trump has just undone decades of deep state brinkmanship and Russia-baiting in Europe to push NATO further and further east. With a few strokes of the pen and a few speeches, that’s all finished, the deep state’s deliberately provoked Ukraine war is all but over, Ukraine will never join NATO and the compliant/complicit European and UK politicians who went along with it are now totally flummoxed and impotent.

The Trump team is even threatening repercussions if the politicians on this side of the pond don’t stop oppressing their people with censorship, two-tier policing and out-of-control immigration. We have just entered a completely new era of politics. Uniparty politicians need to come to their senses and respond to the new reality.

A great piece of analysis.

LP would turn some zones into net exporters and others into net importers. It's a national version of the international interconnectors scenario. The Norwegian Government, having been kicked up the backside by Norwegian consumers, has just realised that being a net exporter increases prices to your own consumers. Consequently, Miliband's reliance on imported electricity is looking very shaky.

https://watt-logic.com/2025/02/21/norway-turning-away-from-electricity-interconnection/