UK Energy Consumption and Electricity Prices

The public is being lied to about the Net Zero "opportunity"

1 Introduction

In a previous article, The Dummies Guide to UK Net Zero[1], published in December 2022, we set out to debunk the egregious lies of the Net Zero agenda. Here, we elaborate on key details of winter energy demand and electricity prices that we omitted from that (already lengthy) paper.

In all the detail, it is important always to remember that there is no climate crisis. It’s all lies, as is being demonstrated, yet again, in the current US court case between Mark Steyn and Michael Mann.

The utter madness of Net Zero is being imposed on us all by a criminal cartel of charlatans making £billions from these scams. Our intent in the following analysis is not to engage in a rigged game whereby we acknowledge any remote possibility of a climate emergency, but to provide further evidence on the pervasive extent of the deception.

2 Overall UK Energy Consumption

In promoting Net Zero to the public, deceitful proponents of “the narrative” cherry-pick figures to give people the impression that renewables now provide a significant proportion of UK energy needs, and will miraculously reduce your energy bills in the sunlit uplands of Net Zero.

This is completely untrue. Climate zealots have infiltrated the UK energy supply industry, and their forecasts of future energy requirements and costs, such as the Future Energy Scenarios[2] from the National Grid Electricity System Operator (NG ESO) are disingenuous works of fiction. They rely, inter alia, on storage and carbon capture technology that doesn’t exist, speculative and unproven estimates of utilisation rates (“capacity factors”), and efficiency savings that are not remotely realistic.

We will get to the eye-watering costs shortly but, first, a brief review of overall energy use in the UK.

As per our previous paper, in 2021 less than 6% of UK energy consumption came from wind, solar and hydro. Including nuclear and controversial “biomass” this rose to about 11%; at least 89% of energy used in the UK in 2021 came from fossil fuels. We are not even close to delivering on the false promise of a UK powered exclusively by renewables.

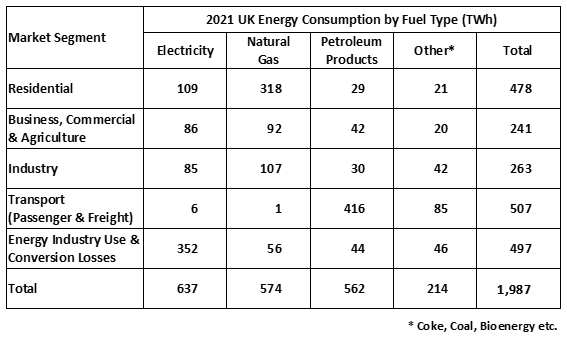

The table below, reproduced from our earlier paper, summarises the UK’s overall use of energy in 2021.

After accounting for waste heat at power stations and other losses, around 1,500 TWh is delivered to end users. If we stop generating electricity from gas, the waste heat (“energy industry conversion losses”) will be substantially reduced, though other forms of “thermal” generation, including biomass and nuclear will continue to produce a residual amount. The same is true for other conversion losses in the above table, so it is the 1,500 TWh of “useful” energy which we need to consider for a Net Zero future.

“But”, say renewables advocates, “energy efficiency measures have already reduced electricity consumption in the UK since our peak demand in 2005. In future, the widespread use of heat pumps and electric vehicles will provide further massive efficiency gains over gas boilers and internal combustion engine (ICE) vehicles”. Let us take a moment to examine these claims.

It is true that electricity demand has reduced considerably in the last 20 years or so, due to a number of factors including rising costs and efficiency gains – e.g. better home insulation, the use of low energy and LED lightbulbs, and more efficient home appliances such as washing machines and dishwashers. We have also outsourced much of our industry, along with the associated energy consumption, mostly to communist China.

As we shall see, the cost of electricity will continue to rise dramatically in the coming years if the Net Zero madness is allowed to continue, but it is likely that the majority of gains from more efficient lighting and appliances have already been realised.

Continuing improvements in home insulation in new properties will likely continue to reduce overall energy consumption, providing additional efficiencies as more new homes are built with electric heating. However, it is questionable how many existing properties will benefit from improved insulation, given the high costs associated with these works.

Popular Net Zero propaganda has it that a typical 2-3x “coefficient of performance” (COP) for air source heat pumps (ASHPs) could reduce energy consumption for home heating by two thirds, and that an efficiency of 80-90% for battery electric vehicles (BEVs), compared to 20-30% for ICE vehicles, could provide similar efficiency gains for transport.

Starting with ASHPs: Firstly, people won't be able to afford them. Typical installation costs of £10,000 plus for an ASHP plus associated plumbing works (new radiators, larger pipes, larger hot water tank) and £5-8,000 for the necessary improvements to home insulation and double glazing will be prohibitive for most. Currently, “early adopters” are being bribed with government grants and incentives, e.g. up to £7,500[3] towards the cost of a heat pump, but this will not help the vast majority of the 28 million households in the UK, once the public funding runs out.

Secondly, those who can afford the installation costs will be unhappy with performance. The low grade heat from a heat pump does not give the responsiveness required – people want a boost of near-instant heat when they're cold. Gas boilers do that pretty well, “resistive” electric heaters even better. In an all-electric future, affluent customers would use electric fan heaters and radiators, or wood burners (as in much of Scandinavia) for top-up heat, while less well-off customers, unable to afford a heat pump, would have no choice; wood burners or resistive electric heaters (with astronomical running costs) would be their only options.

When network losses are factored in (currently around 10% in the UK[4] and, for technical reasons, likely to increase as electricity demand rises under Net Zero initiatives), the use of resistive electric heating is no more efficient than a modern gas boiler – even in a scenario where all electricity is provided by renewables. However, since around 40% of the UK’s electricity today is still provided by gas generation, at something like 50% efficiency, the effect of replacing gas boilers is net negative at present in terms of primary energy consumption.

Even in a fully Net Zero future, depending on which scenario you believe, perhaps 10% of electricity is still envisaged to come from fossil fuels, with associated losses which will increase due to proposed carbon capture facilities. So the replacement of gas boilers with resistive electric heating, and a relatively small number of sporadically used ASHPs, is unlikely to provide significant improvements in energy efficiency overall.

Moving on to BEVs. The drivetrain (battery & motor) is typically around 85% efficient overall in UK conditions. We can then deduct 10% to account for network losses as referenced above, plus another 10% for in-vehicle heating & air conditioning use, plus 5% for generation losses, assuming 10% contribution to electricity generation from combined cycle gas turbines, CCGT, at 50% thermal efficiency.

A BEV is also carrying a large weight penalty over an ICE equivalent, courtesy of its heavy batteries, so we can reduce efficiency by perhaps a further 5% to cover the additional work required under acceleration (offset to some degree, but not completely, by regenerative braking). Finally, overall efficiency is impacted by other miscellaneous items such as seat heaters, windscreen wipers, and lighting.

In practice, then, BEV's in the UK are unlikely to be much greater than 50% efficient overall, even in a full Net Zero scenario. At present, we are far from a full Net Zero scenario, so BEV's today provide little to no net efficiency benefits over comparable ICE vehicles.

To summarise, BEVs and ASHPs would result in some incremental efficiencies in a Net Zero environment, but nothing like the exaggerated claims of the climate alarmist charlatans. Taking account of all efficiencies - from home insulation, ASHPs, BEVs and elsewhere – it is possible that the UK could achieve perhaps a 20% reduction in primary energy consumption overall. This would reduce our annual requirement for delivered energy from 1,500 TWh to 1,200 TWh.

In 2021, all renewables combined provided about 120 TWh, or 10% of estimated future requirements – with nuclear providing another 42 TWh, or 3.5% - so even with realistic energy efficiency improvements, we are currently 86% short of the renewable electricity we’d need to achieve Net Zero.

Closing this gap can only be achieved by a massive reduction in energy use and/or an enormous increase in renewable generation. Both are seriously problematic, but this does not trouble the globalist ‘elites’ of the UN and its agencies (the IPCC & the WHO), the WEF, the Bill & Melinda Gates Foundation (BMGF) and others. After all, they want you to “own nothing and be happy”[5].

However, it is important to note that the implications of Net Zero go much wider than the amount of energy we would need to produce annually. In the UK, unsurprisingly, peak demand for energy occurs in mid-winter. On a cold January day, overall energy consumption might be 900 GWh electricity, 3,000 GWh gas (excluding that used to generate electricity) and 2,200 GWh oil – over 6 TWh in total. This implies that peak daily electricity demand in a Net Zero future would be more than 5 times (6,000 * 0.8 / 900) what it is today, taking account of estimated efficiency improvements of 20% as discussed above. Even if, through the use of ‘smart’ grids and demand management, we could smooth the demand curve almost completely – so that this power is used evenly throughout the day, that would imply a peak simultaneous demand of around 250 GW, compared to just under 50 GW today.

It is not rocket science to see that cables and wires designed to deliver 50 GW will quickly collapse with an instantaneous demand of 5 times that amount. So, to deliver all this extra electricity to where it is needed, the national transmission and regional distribution networks will require massive upgrades.

3 Electricity Prices - Past, Present and Future

Many sceptics of the climate alarmist and Net Zero propaganda focus on future economic risks, but the renewables madness has already had an enormous impact impact on the price of electricity in the UK, even though renewables currently account for only 10% or so of our ultimate energy needs. There are many different ways of calculating costs, some of which are very complex, but we will take a fairly simplistic approach for the purposes of a brief introduction.

Back in 1980, the central electricity generating board (CEGB) was responsible for the vast majority of power generation and transmission – the high voltage “grid” – in the UK. The CEGB sold electricity to the regional “area boards”, who were responsible for the lower voltage “distribution networks” and for the retail sale of electricity to end users.

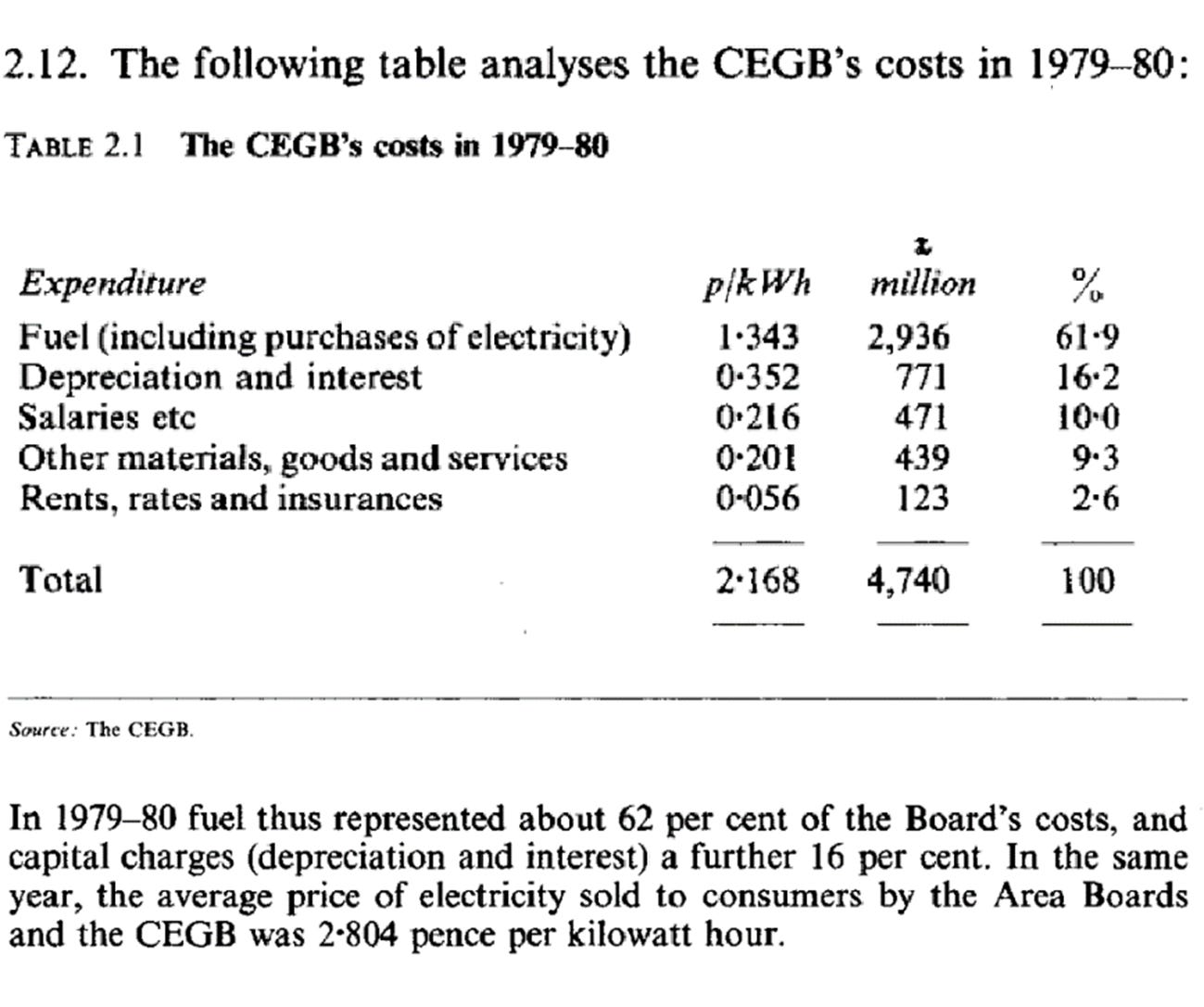

In 1981, the Thatcher government commissioned a report[6] into the CEGB from the Monopolies and Mergers Commission (MMC). Included in this report was a revealing section about costs, reproduced below.

In 1979/80, fuel (primarily coal) represented 62% of the CEGB’s costs – which, including transmission, represented 77% of the entire retail price charged by the area boards to consumers. When transmission costs were removed, the prevailing industry wisdom was that generation alone represented about 60% of the retail price at that time.

By contrast, in 2021, according to figures published by Ofgem[7], wholesale (essentially generation) costs accounted for less than 30% of your final bill.

What is going on? Maybe it’s because renewables produce electricity “nine times cheaper than gas” as was notoriously claimed[8] by Carbon Brief, an infamous Climate Alarmist and Net Zero propaganda outfit, in July 2022? Sadly not. The Carbon Brief story was an outrageous piece of misinformation – but that did not of course prevent many mainstream media outlets from gleefully repeating the disingenuous nonsense.

A method for investors in wind and solar farms to work out the investment case for a new development – and therefore what price they should bid at in government auctions for new capacity - is “Levelized Cost of Energy[9]” (LCOE). LCOE calculates the lifetime costs of construction and operation, including the cost of capital, and determines the break-even price of electricity sales based on assumptions about how much electricity will be produced over a facility’s operational life. Immediately, the use of LCOE and the associated assumptions about electricity sales “rig the market” in favour of renewables, for two main reasons.

Firstly, LCOE only covers the direct costs of the wind or solar farm’s developer – the cost of constructing the facility including, in the case of an offshore wind farm, offshore substations and cabling to deliver power to shore. It does not include the extension and/or reinforcement of the transmission grid on land, to deliver the power to where it’s needed. Nor does it include the cost of backup fossil fuel generation – still needed for when the wind doesn’t blow – or the cost of grid ancillary services, such as high-speed, short-term battery backup to stabilise the system in the event of a fault (the lack of system “inertia” with renewable generation is briefly described in our previous paper).

These additional costs of renewable power are not included in wholesale cost calculations, but are “socialised” and incorporated in hidden subsidies, which appear under ESO and Network Costs in Ofgem’s pie chart.

Secondly, assumptions about how much electricity will be produced over a facility’s operational life are based purely on the expected “capacity factor” (CF) of each facility. The CF takes account of the intermittent nature of the wind and sun (including hours of darkness) to estimate the actual output of a wind or solar farm compared to the theoretical maximum of flat-out, 24x365, operation. In the case of a wind farm, for example, the CF might be between 40% and 50%, depending on the location and the type/size of turbines. This assumption is rooted in the fact that, because wind and sunshine are free (when available) the “marginal cost” of renewable generation is very low. In the absence of fuel costs, marginal costs consist only of additional maintenance and repair expenses associated with running plant, rather than having it stand idle.

Marginal costs for renewables will therefore always out-compete other forms of generation and, save for one outstanding risk, a wind or solar farm will always be able to sell all the power it can produce. That outstanding risk is that the market does not need or cannot use the power – e.g. if strong winds at 3 am on a Summer morning mean there is an excess of supply over demand, or if the transmission grid is not capable of delivering the power to where it’s needed.

But there is no need for renewables operators to worry about this; the “market” has been rigged in their favour. Under “contracts for difference” arrangements, wind and solar farms offered guaranteed minimum “strike” prices for all the useable power they produce, and they also receive “curtailment” payments if their power cannot be handled by the grid. In a world where renewable generators are paid a guaranteed minimum, via contracts for difference, wholesale (and retail) prices can sometimes go negative[10] – whereby customers are actually paid to use electricity. If a generator knows they will receive a subsidised strike price of, say, £50 per MWh, and their marginal cost of generation is negligible, they can afford to pay £25 to offload power and still be in profit.

Given all the ways in which the system is rigged in favour of renewables, it is hard to see how an operator of a wind or solar farm can lose; no wonder fanatical advocates of renewables are so evangelical about the “benefits”. Nevertheless, there have been a couple of serious setbacks for offshore wind recently. In June 2023, shares in Siemens Energy fell 30%, after they issued a profits warning following higher than expected failure rates of wind turbine components. Shortly thereafter, the most recent UK government auction (“AR5”) for offshore wind was an embarrassing flop[11]. The failure was blamed on rising costs in an inflationary world but, as usual, we were not told the whole truth by a mainstream media fully complicit in an egregious deception of the British people.

CfD strike prices are effectively incorporated into contracts as “options” for generators – which provide a floor price when wholesale spot prices are low. If wholesale market prices remain above the strike price - e.g. during a transient spike in the price of gas - renewables generators can take the market price rather than invoke the safety net of the strike price option.

Many renewables generators were able to game this system, by “bidding low” in auctions but never needing to invoke their contracted strike price options. The “£48 per MWh” quoted in the Carbon Brief article referenced above was never real. Actual prices for “cheap” renewables never approached the bargain basement levels so often touted in industry propaganda, dutifully regurgitated by an ignorant, but willingly complicit, mainstream media.

In AR5, the chickens came home to roost. The industry demanded realistic strike prices, and they spurned the capped auction price - £44 per MWh in 2012 prices, or around £60 at 2023 inflation-adjusted rates. In response, the UK government has now increased the strike price cap for offshore wind in this year’s AR6, from £44/MWh to £73/MWh, in 2012 reference prices (around £100 in 2023 inflation adjusted terms). The cap for floating offshore wind will rise from £116/MWh to £176/MWh (£240 in 2023 prices). These represent massive increases of 66% and 52% respectively over the failed AR5.

If we consider the inflation adjusted figure for offshore wind of £100 per MWh – equivalent to 10p per kWh – and refer back to the Ofgem pie chart above for retail prices, whereby wholesale costs represent about 30% of your final bill, this indicates a retail price of 33 pence or so per unit. This is actually higher than the current price cap. The AR6 auction will permanently bake in elevated retail electricity prices for the UK, but the reality will in fact be far worse.

How is it that the current Ofgem price cap is less than the true cost of wind (and solar) power? The answer is that these “cheap” renewables still, fortunately, only account for about 40% of electricity produced. Gas and legacy nuclear, being significantly cheaper, bring down the average cost a little, though new nuclear plants such as Hinkley Point C will also operate with guaranteed strike prices. The reduction from gas would be considerably more, but for the fact that the green madness also breaks the market for fossil fuels, in a number of ways:

Firstly, fossil fuel generators emitting CO₂, are subject to carbon taxes. After Brexit, the UK initiated its own emissions trading scheme (ETS), which operates in a similar way to the EU ETS, with UK market prices typically around £50/tonne.

Aside from the explicit costs associated with carbon taxes, both generators and suppliers are impacted indirectly by the bureaucracy which always accompanies government regulation – for example in administering the climate change levy[12] (CCL) on business customers, which complicates both administrative processes and the necessary IT support systems. Any small business owner who has dealt with VAT returns knows just how onerous it can be to act as an unpaid tax collector for the government. Various other costs of bureaucracy arise from the additional bodies set up to oversee the “green transition” – for example the Climate Change Committee[13] (CCC), an “independent” quango whose job is essentially to monitor progress towards Net Zero, and the Low Carbon Contracts Company, which manages Contracts for Difference and Capacity Market operations.

All this bureaucracy does not come cheap, although highly paid quango personnel and industry consultants do rather well, as ever. It’s an ill wind that blows nobody any good, as they say.

Then there is the impact on efficiency of operating gas plants as intermittent backup sources. Just like a car engine, the efficiency of a modern combined cycle gas turbine (CCGT) is affected by a number of factors. Ambient temperature and atmospheric pressure have relatively minor effects, but the running pattern is the critical factor. Again, just like your car, if a CCGT runs for brief periods from cold, or at a non-optimum output level on the torque curve, efficiency can be seriously reduced. All drivers know they will get better fuel efficiency on a long run at steady speed than from a short trip in town.

By forcing gas plants to act as backup for intermittent renewables, we are basically using our highly efficient CCGT’s for many short trips in town. This means reduced efficiency (higher costs) when they are running, plus large periods when they sit idle, earning their operators no money. To encourage gas generators to keep their poorly utilised plants open, and even to build new ones, wholesale markets now include a “capacity payment” mechanism, whereby generators are paid to retain backup capacity which might sit idle for long periods – one of the many hidden subsidies needed to make renewables viable.

There is a further point about the impact of renewables on the cost of CCGT generation which is a little more nuanced. In the past, when the requirements for gas generation was predictable, because things were not dependent on the vagaries of the weather, operators were able to plan their fuel use very accurately. This enabled them to “buy forward”, fairly precisely, the volumes of gas they would need for any particular period. They could ensure stable fuel payments, avoid buying when futures prices peaked, and fully hedge against related risks such as fluctuations in foreign exchange rates. When the UK had a mix of gas and coal generation (not so long ago!) they could also plan to generate more with coal when gas future prices peaked, and vice versa.

In today’s unpredictable conditions, where they are the only high-volume backup for renewables, gas generators are more exposed to volatility in short-term gas markets – further increasing their costs, though to a degree which is impossible to quantify with any accuracy.

In a purely market-driven world, modern CCGT producers would be free of carbon taxes and capacity charge subsidies. They would run their plant at optimal efficiency, i.e. continuously and at full output capacity, and they would buy gas ahead in the forward markets, at the most advantageous prices. In short, their generation costs would be minimised as far as possible.

“Minimised” at what level? To get a rough idea, let’s return briefly to the wholesale and retail prices in 1979/80, as detailed in the 1981 Monopolies and Mergers Commission report. If the UK had never embarked on a “renewables energy revolution”, what might we expect retail prices to be today, and what does that tells us about the true cost of renewables once hidden socialised costs are factored in?

After the massive spike in natural gas prices following the Russian invasion of Ukraine which, remember, Carbon Brief exploited to make their outrageous “renewables are 9 times cheaper” claim, prices are now back down much closer to the long term average (currently 67 p/therm – about 2.3 p/kWh).

Modern CCGT gas generators can reach efficiencies of 60% running continuously at optimum output levels, indicating a marginal cost for electricity produced of ≈ 3.8 p/kWh.

Of course, there are other operational costs (staff, maintenance, etc.) as well as capital depreciation over the life of the plant, cost of capital etc. Andrew Montford, of Net Zero Watch, has recently estimated actual costs of CCGT generation (based on audited accounts) of around £70/MWh, or 7 p/kWh.

We are not in 1981, and gas is not coal, but we can estimate what a 7 pence per unit wholesale price might mean in broad terms, by calculating an indicative retail price using the established fraction of 60% in common use at the time of the MMC report. This would give a retail price, in the absence of all renewables, green subsidies and so on, of 7/0.6 11.7 p/kWh. One third the true price of offshore wind. Far from wind being 9 times cheaper than gas, it is in fact 3 times more expensive.

In a purely commercial market, free of political interference, wholesale prices for coal-fired generation would potentially be even cheaper than gas, especially if punitive carbon taxes were dropped (coal is taxed more than gas because of its higher carbon content). In the headlong rush to “decarbonise”, coal has become a particular bête noire to climate alarmists in the UK, though most of the world, especially China and India, continue to use coal in enormous volumes[14].

The UK has up to 3 billion tonnes of remaining coal resources, with possibly significantly more under the North Sea. Compared to some other countries, recovery of UK coal resources, primarily from deep mines, is relatively expensive – meaning that “proven reserves” which are “technically and economically recoverable” are somewhat less than total resources. However, even at elevated prices compared to foreign coal, we could generate electricity from coal several times cheaper than the true cost of renewables. If the UK were to lift its insane moratorium on the use of coal, it would then be a political judgment to balance the additional costs of home-produced coal against the benefits of energy independence and security of supply.

We cannot end this discussion of ‘green’ costs without briefly mentioning smart metering. The latest (2019) official cost estimate[15] for the UK program was £13.4 Billion – equating to around £480 per household. In reality, however, with continuing delays and cost over-runs, it is likely to be significantly more. In theory, by obviating the need for frequent meter reader visits, some savings should be realised in the longer term, but the same could have been substantially achieved via estimated and customer readings.

In summary, renewables are already at least 3 times the price of generation from fossil fuels (gas and coal), and 4-5 times the price of natural gas currently used for most home heating. But imagine a world where the UK relies on renewables for the lion’s share of its overall energy needs, in an all-electric future. Because of intermittency and the low capacity factors of wind and solar, together with the lack of storage capacity at scale, we will need to “overbuild” generation capacity.

This means that, at times when the weather is favourable, we will not be able to use all the power that can be produced – unless, for example, we can produce large volumes of “green hydrogen” using the surplus. The low round trip efficiency (around 35%) of using green hydrogen to then generate electricity when the wind drops, will mean significant additional costs. The alternative, much more likely scenario, is that we significantly increase the use of (market) curtailment mechanisms, whereby we pay some wind generators to shut down in periods of UK-wide high winds.

Insane does not begin to describe it. Retail energy prices, already barely affordable for a large proportion of UK citizens, will become ever more expensive as the percentage of renewables grows, fossil fuel generation is further reduced, and electricity from wind and solar replaces the consumption of gas and oil for heating and transport.

[2] https://www.nationalgrideso.com/document/283101/download

[3] https://news.sky.com/story/heat-pump-grant-increased-to-7-500-by-government-in-efforts-to-lower-pollution-and-bills-12990844

[4] https://publications.parliament.uk/pa/cm201415/cmselect/cmenergy/386/38607.html

[6] https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/

228961/0315.pdf

[7] https://www.ofgem.gov.uk/search/data-charts?keyword=breakdown%20of%20an%20electricity%20bill

[8] https://www.carbonbrief.org/analysis-record-low-price-for-uk-offshore-wind-is-four-times-cheaper-than-gas/

[9] https://guidetoanoffshorewindfarm.com/wind-farm-costs

[10] https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/441809/

Baringa_DECC_CfD_Negative_Pricing_Report.pdf

[11] https://news.sky.com/story/offshore-wind-power-warning-as-government-auction-flops-12956522

[12] https://www.gov.uk/green-taxes-and-reliefs/climate-change-levy

[13] https://www.theccc.org.uk/about

[14] https://www.iea.org/search/charts?q=Global%20coal%20consumption

[15] https://assets.publishing.service.gov.uk/media/5d7f54c4e5274a27c2c6d53a/smart-meter-roll-out-cost-benefit-analysis-2019.pdf

Excellent analysis. Just two small extracts which our politicians ought to be able to take in, but won’t because their aim is the wreck our energy infrastructure:

“Far from wind being 9 times cheaper than gas, it [offshore wind] is in fact 3 times more expensive”

and

“Insane does not begin to describe it. Retail energy prices, already barely affordable for a large proportion of UK citizens, will become ever more expensive as the percentage of renewables grows …”

Thank you for a very interesting article, which I came to via your comments on David Turver's latest offering.

I have to say I almost stopped after the first three paragraphs as I feared it was going to continue as a rant, whereas things settled down and very serious and evidence-based observations were made, so I'm glad I continued.

I mention this, I hope politely, as I prefer to have my facts served without sauce and gravy, regardless of the author or which direction they're coming from, and however sincerely strong views are expressed. For what it's worth, I've become very tired of the mantra of the cheapness of wind and solar so I'm not expressing a partisan prejudice here.

I'll finish by thanking you again for your efforts which are much appreciated.