The Costs Rise & the Blackouts Begin

The gaslighting though will continue though, that much is guaranteed.

Large areas of Spain, Portugal, and parts of Southern France are currently without electricity after a major power outage hit at lunchtime today.

We can now expect the usual plethora of mostly baseless rumours, alongside obfuscation and distraction from the mainstream media - in no time at all, they’ll be rolling out their usual paid activist “experts” to explain that we need more windmills, more “storage” batteries, and more simple belief in the cult of Net Zero. Oh, and more money for the grifters, of course! Most of these “experts” will not have the first clue, but they have the correct agenda, so they will be platformed regardless - just as a number of them were recently on Iain Dale’s LBC show.

None of the participants in this LBC “debate” have any direct coal-face experience of the energy industry. All but Richard Tice are perennial anti-fossil fuel activists, each of them demonstrable, shameless spreaders of disinformation who claim, in contradiction to all true facts (as they are all well aware) that UK electricity prices are high due to the “high cost of gas”.

It’s a complete nonsense. One of the charlatans later posted the following in a LinkedIn exchange. His cult followers, naturally, love it. But it’s a complete, and knowing, lie.

The truly insulting thing about Liebreich and others’ gaslighting nonsense is how easily it can be debunked. They know this, and they simply don’t care, because they also know that their useful idiot followers are so completely indoctrinated into the Net Zero cult. Watch them now, having regurgitated the false narrative of “secure green power” for so long, attempt the complete memory-holing of any inconvenient facts such as the current widespread power outage in Iberia.

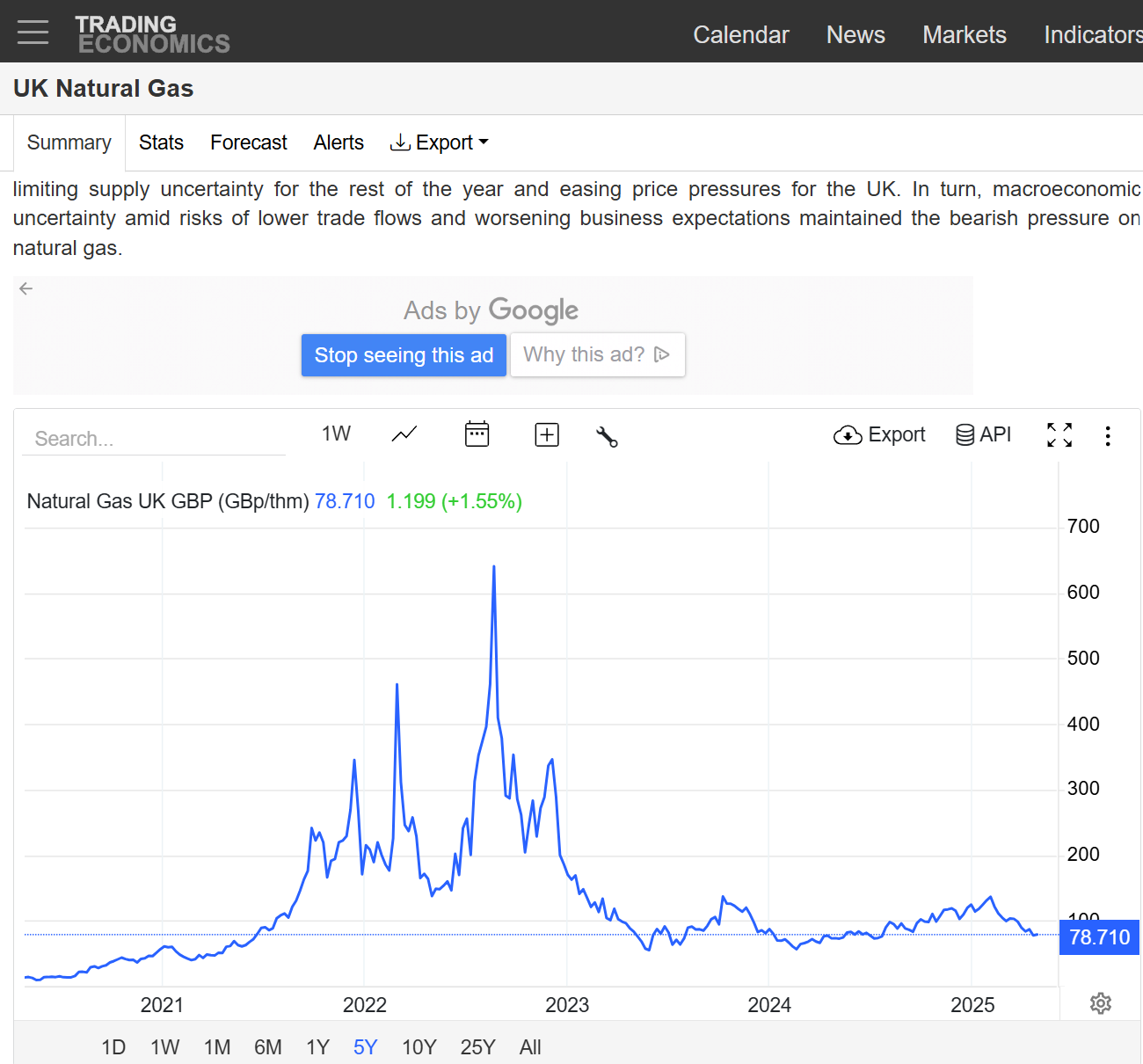

Liebreich’s chart ends, conveniently for his deceitful narrative, in 2022. Let’s look at the up-to-date chart - where UK wholesale gas prices have fallen to 78p/therm, or ~2.7p/kWh. CCGT gas plants typically burn gas at around 50%, so the marginal fuel cost of these plants is presently 2 x 2.7 = 5.4p/kWh. The current Ofgem retail price cap for electricity, excluding standing charges, is 27p - which so obviously has nothing to do with the price of gas that any such claims should be summarily laughed out of the room.

But let’s dig a little deeper into some salient facts.

CCGT wholesale prices are not reflected exclusively by spot gas prices at day-ahead. Excluding real-time balancing, which is a separate issue, the electricity wholesale market divides into two parts:

Forward markets, whereby generators and suppliers hedge their positions for month or years ahead.

As you would instinctively expect, forward market prices are somewhat influenced by expectations of future day-ahead prices (why sell your generation today at “x”, if you thought you could sell at “2x” it in the day-ahead market, or buy it today at “2y” if you thought you could buy it at delivery for “y”?) but forward hedges are primarily about the risk reduction that comes from the certainty of knowing your future exposure. Forward market and day ahead prices are therefore loosely coupled - and of course, in 2021, few foresaw the huge spike day-ahead prices which resulted from the invasion of Ukraine in 2022.

Forward market prices have 2 main influences on the overall average of wholesale electricity costs. They directly set the price of CCGT contracts, and they inform something called the “baseload market reference price” (BMRP), which then in turn determines the subsidies paid to baseload “renewables” and “low carbon” operators, i.e. nuclear and biomass.

So the wholesale gas price spikes in early 2022 had very little immediate effect on a large part of the gas, nuclear and biomass components of the UK’s electricity mix. However, because these high prices were sustained for over a year, they did subsequently impact on forward hedges and the BMRP.

It is difficult to assess the percentage of electricity sold in the forward markets, since trades in this market are not public knowledge, but most informed estimates put it at about 60-70%. Interested readers can ask the various AI search engines to provide a commentary.

The day-ahead markets are operated through an auction process, from which arises the now infamous “system marginal price” (SMP) then applied to all accepted day-ahead bids.

The SMP is set at the price of the highest - last, or “marginal” - accepted bid which, typically, is a lower efficiency (and thus rarely called upon) gas plant. As with using your car only for occasional short trips into town - while it’s resale value reduces with the passage of time and the engine never really gets warmed up - such “low merit order” gas plant is quite clearly going to cost more per kWh (per mile) than plant running flat out most of the time (a car used daily for long motorway trips).

Whether the SMP is an appropriate mechanism continues to be the subject of fierce debate but for now, rightly or wrongly, it is the system we have in the UK. However, crucially, the SMP is not the actual price received by intermittent “renewables” (i.e. wind & solar) generators. This is a point completely obfuscated by the disingenuous advocates for these technologies - and, frustratingly, rarely clearly explained by fellow sceptics.

The SMP, which renewables generators do receive as direct (but entirely fake) “wholesale” trades, then sets something called the Intermittent Market Reference Price (IMRP). This then sets the baseline for intermittent wind and solar subsidies, just as the BMRP does for nuclear and biomass.

With regard to wholesale prices in general following the invasion of Ukraine, it is important to remember a little-discussed nuance which has since been conveniently memory-holed: The continuing spike in wholesale electricity prices during early 2023 was in part due to a shameful decision by the then chancellor, Jeremy Hunt, not to intervene directly in the wholesale markets (i.e. with temporary price caps/subsidies) but to introduce a new 45% windfall tax for power generators - the Electricity Generator Levy, still in effect today, which took effect from Jan 1st 2023 and applies to all renewables electricity sold above a baseline £75 per MWh. This must be seen in the light of the huge expenditure (advocated by Hunt - a huge fan of lockdowns and vaccine coercion) on the “Covid” fiasco in the preceding years - Hunt effectively introduced a stealth tax, which increased government tax revenues at the expense of hard-hit energy consumers and raised wholesale electricity prices significantly more than was needed, had the Tory government behaved more responsibly at the time. This of course was very shortly after Liz Truss had been defenestrated by a totally corrupt establishment - most of these things are connected (and Jeremy Hunt, among many others, should be in jail)!

An average of BMRP and IMRP reference prices represents the true wholesale price received by gas generators. The lack of fully transparent data relating to forward market trades make this average difficult to estimate precisely, but a reasonable estimate is 8.5p/kWh. For gas generation, this includes carbon taxes, which we estimate at 1.5p/kWh on average, giving a true wholesale market price for gas generation of around 7p/kWh.

The true wholesale price received by renewables generators, on the other hand, is the price received in the wholesale markets (essentially the relevant BMRP or IMRP) plus whatever subsidy amounts apply. We have covered these subsidies in previous articles, but we recommend the excellent summary proved by David Turver on his own Eigen Values Substack page and on TwiX.

David’s assessment results in a total £15.4 billion of Net Zero related annual costs, most of which (£11.9 billion) relate directly to subsidies, with another £3.5 billion from balancing and capacity market costs. Averaging £11.9 billion across the approximate 170 TWh (170 billion kWh) produced from all subsidised sources in 2024, we get an average direct subsidy payment of ~7p/kWh.

The true average price of all “low carbon” and “renewables” generators is therefore the 8.5p false wholesale price, plus the 7p average subsidy, or 15.5p/kWh - almost twice the price of gas generation.

As is repeatedly pointed out by every Net Zero “sceptic”, and ignored by Net Zero charlatans, the wholesale cost of electricity is far from the full story when considering the retail price that we all actually pay - currently capped at 27p (excluding standing charges) by Ofgem.

If we consider the Ofgem estimate of average electricity consumption for a medium size household (2,700 kWh/year or 7.4 kWh/day), the daily standing charge of 53.80p adds the equivalent of 7.3p per kWh - resulting in a total average retail price of 34.3p/kWh, only 7p (20%, or 1/5) of which is the true cost of gas generation.

The rest of your retail bill - the large majority - comes from other components of the retail electricity supply chain, and from other Net Zero and social policy costs.

These include network costs - transmission and distribution (which is rarely mentioned) - an increasingly large percentage of which arises from the need to extend and reinforce both networks to cope with Net Zero demands. We estimate the total investment required to achieve a Net Zero network infrastructure to approach £600 billion.

Other price elements come from supplier costs (including the cost of bailing out multiple failed suppliers in recent years, and the budgets of numerous Quango’s and trial project participants aboard the gravy train; carbon capture projects, the unachievable “hydrogen economy”, floating offshore wind, novel storage technologies, and more.

In summary, the true wholesale cost of “renewable” energy is approximately twice the cost of gas generation. The true retail cost is five times the gas generation cost - due to carbon and windfall taxes, network and supplier costs, and various other policy costs and grants which are primarily related directly to the Net Zero madness.

Crucially, as is sadly being demonstrated by the ongoing power outage in Iberia, this ruinously expensive farce does not even lead to “secure home-grown power”, as our gaslighting criminal UK energy secretary, Ed Miliband, keeps claiming.

Let us hope, calamitous as the current blackouts are for the unfortunate citizens of Spain and Portugal, this current disaster finally acts as a wake-up call for Europe.

Great post. I just watched Matt Goodwin’s latest State of the Nation: https://www.youtube.com/watch?v=7kPQj2gMh9w.

At 33:40 he does a segment on deindustrialisation and electricity prices. He talks to David Turver who explains that electricity prices are so high because Miliband is “fire-hosing” money into renewables and goes on to say that the whole thing is a religion (I think it’s more malign). In the subsequent panel discussion, the leftie Michael Walker is a dead-ringer for those you describe on the Iain Dale Show. Unfortunately Matt Goodwin doesn’t manage to tackle him very well. Maybe you should try to get on his programme yourself!

The obvious reaction from the greenies is going to be "we need to spend even more money on grid resiliency."